インドネシア・リアウ州における泥炭火災の特徴とその発生要因の解明

対象とする問題の概要 インドネシアでは泥炭地で起きる「泥炭火災」が深刻な問題となっている。泥炭火災とは、泥炭地で起きる火災である。泥炭地は湿地内で倒木した木が水中でほぼ分解されず、そのまま土壌に蓄えられた土地であり、大量の有機物が蓄えられ…

After the second round of fieldwork during June to August 2018, the study revealed that Lao entrepreneurs were enthusiastic about operating their firms under self-management as a family business rather than seeking local and foreign partners. At the same time, self-financing was the main method of initial capital for business establishment, and many companies, particularly private companies, changed their fundraising behaviour to accessing bank borrowing together with their remaining funds after the businesses had been operating for a certain period of time. From the balance sheet, we observed that the debt ratio in private companies was slightly higher than that of state-owned enterprises and very low in public companies. Not surprisingly, public companies tended to shift their fundraising from debt finance to equity finance. Therefore, further observation of the companies listed on the Lao Securities Exchange is necessary to determine if they really benefit from listing on the equity market or their situation worsens after the listing period.

This research descriptively observes the performance of firms that have already been listed on the Lao Securities Exchange to understand the advantages and challenges of going public. Hence, to respond to the question of how IPO issuance and listing on the stock exchange could affect the performance of the firm, we examine the balance sheet and income statement of listed companies within the prior and post-listing periods to observe the change in the capital structure of the firm before and upon listing.

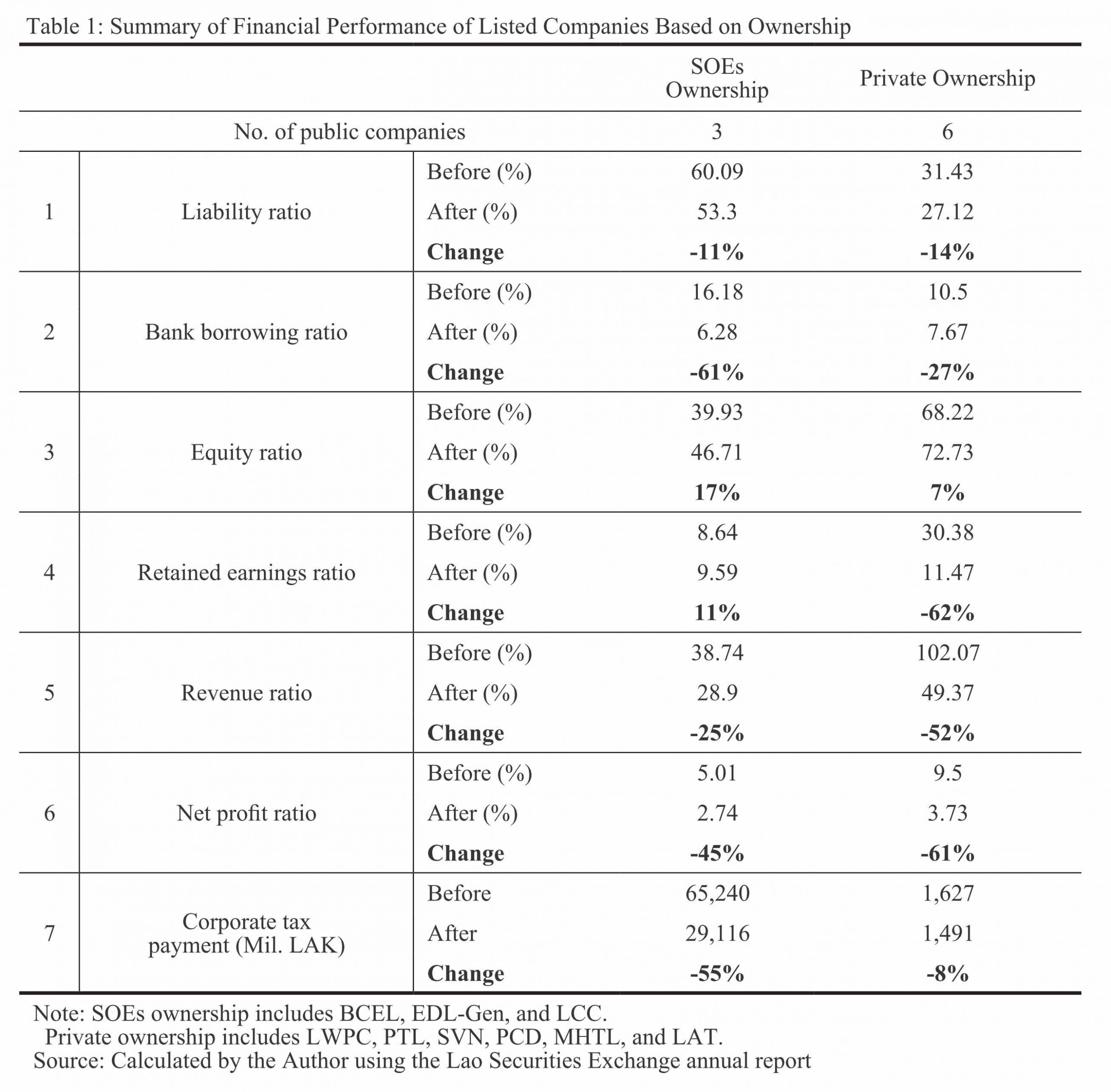

As of August 2019, there are 10 listed companies on the Lao Securities Exchange, nine of which were observed in this study. From the balance sheet and income statement observation (see Table 1), we find a declining trend of debt and bank borrowing ratios in the firms upon listing on the local stock exchange, while the component of equity-retained earnings is replaced by other capital surplus gained at IPO. Revenue and profit also declined after listing, which is possibly a reaction movement of the firms that had rigidly kept listing criteria by clearing the requirement before listing. These changes in financial performance after going public are mostly positive and advantageous in state-owned enterprises (SOEs) but we do not observe the same changes for private ownership.

From this fieldwork, we found that the choice of going public and listing on the local stock exchange could at least diversify the capital structure and reduce the borrowing constraint of the firm. This core argument is already presented throughout this study. However, further investigation should also consider unlisted firms by comparing the financial performance of both listed and unlisted firms to concretely understand the primary differences and characteristics before recommending going public as their alternative choice for firm improvement.

Copyright © 附属次世代型アジア・アフリカ教育研究センター All Rights Reserved.