DRコンゴ・ボノボとヒトの共生の場の人類学的研究

対象とする問題の概要 本研究の調査地であるワンバ(Wamba)周辺地域およびバリ(Mbali)地区は類人猿ボノボの生息域である。ワンバ周辺地域では1970年代からボノボの調査がはじまり、内戦時の調査中断とその後の再開を経て、現在までおよそ…

Laos is located in Southeast Asian, sharing borders with China and other four ASEAN states. This country is surrounding with various neighboring states, but it is landlocked country, not able to access to the sea. This characteristic becomes the most obstacles for Laos to open its market to the world. However, the Lao economy seems to grow annually and becomes one of the fastest economic growth nations in the region, base on the world bank report, gross domestic production growth rate was 7% in 2016 with 2,457 USD as GDP per capital (2017)[1]. Despite having high economic growth rate, the local businesses and people are heavily relying on external products as having high material and products import. This characteristic becomes a priority concern for Lao government to minimize the external product consuming. Thus, the local investment observation is really necessary in order to understand the domestic capacity of producing and find out the appropriate policies for facilitating local business operation, especially assisting them to finance source. Therefore, the author plans to carry out the corporate’s finance survey by focusing on medium and large enterprises in order to recognize their barriers of finance access for business operation with clearly understanding their financial structure.

[1] The World Bank Group

This research aims to investigate the corporate system, including the corporate’s financial structure, fundraising behavior, financial issues, understanding and incentives to equity market from corporate’s side. Moreover, this study will also observe the situation and reform of state-owned-enterprises in Laos.

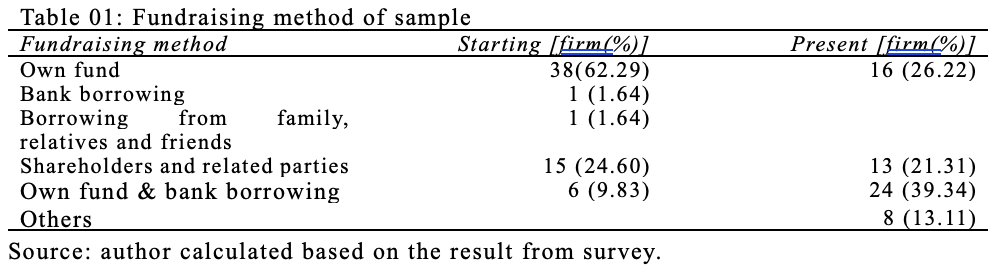

Following the result of this fieldwork, we have visited 61 firms, 49.2% of which are limited companies. To be more specifically, 26.2% are doing business in manufacturing/producing sector, 11.5% are information and telecommunication, 9.8% are transportation and postal service, the least are in other sectors. Most of the firms have operated their business by utilizing their own fund (self-financing) from the beginning of establishment, and then changed their financial behavior into bank loan and some firms receiving contribution from shareholders, especially private firms (as shown on the table 1).

When we deeply observe the bank credit provider to our sample, we found that full and joint state commercial banks are the most nominated and prominent bank transaction and source of fund, particularly in firm’s deposit account and bank loan. Moreover, the collateral concern is shown to be the biggest obstacle to access bank loan from many firms, particularly state owned enterprises. Furthermore, trade credit is also applied to various firms as another alternative to avoid bank loan burden. The stated points are some of the key findings from this fieldwork during June 02 – August 28, 2018.

This is the preliminary fieldwork of corporate’s fundraising research, it is required to understand more on different dimension, especially in another side of enterprise type, for instance state owned enterprise (SOEs). Therefore, further survey and information collection on SOEs are needed. In addition, the possible solution for minimizing the SOEs’ finance obstacle should be also analyzed, particularly in capital market section as alternative option for SOEs’ finance source.

Copyright © 附属次世代型アジア・アフリカ教育研究センター All Rights Reserved.